A common question I get from travel reward beginners is the difference between a soft pull and a hard pull on your credit check report. This question usually comes up when someone is interested in buying a home or a car. AKA, a big life decision and purchase. Both terms are used frequently when discussing applying for new credit cards, but how does each play into your credit score?

The major difference between the two is that a hard pull appears on your credit report while a soft pull does not.

Related: My Favorite Travel Reward Cards

What is a hard pull?

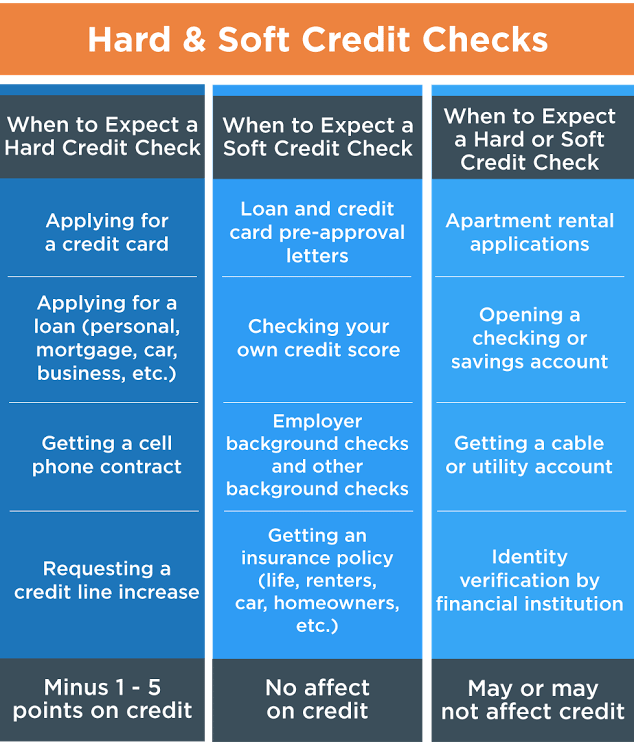

A hard inquiry is a type of credit information request that includes your full credit report and deducts points from your credit score. These types of inquiries are used by lenders and creditors in deciding whether to grant you credit or a loan, and they will usually cause a short-lived decrease in your credit score. A “hard pull” is another name for a hard inquiry.

These checks are tied to an application and will, therefore, show up on your credit report. That means they could potentially impact your score, since new inquires on your credit report are a factor in determining your credit score. What is considered an official application? Anytime you send in a request for a line of credit, where you are sharing your full identification details such as your name, address, social security number and more.

A hard pull results in the lender getting your official credit report and credit score from whichever bureau it requested the information. This is a much more in-depth look at your credit history compared to what might be collected and sent over after a “soft pull.”

When are hard pulls performed?

As mentioned above, hard pulls are almost always connected to an application for credit of some sort. Buying a house or a new car? How about renting your first apartment? All of these instances are hard pulls. Credit card issuers generally run hard pulls when you apply for a new card (though there are some exceptions to this). Private student loan lenders will also run a hard pull on your credit.

What is a soft pull?

A soft inquiry—also called a “soft pull”—allows a creditor to review your credit report and credit score to get a sense of how well you are managing your credit.

When are soft pulls performed?

A soft credit inquiry can occur even when you check your own credit report. Below are some of the most common examples of soft inquiries:

- You give a potential employer permission to check your credit.

- Financial institutions that you already do business with check your credit.

- Credit card companies that want to send you preapproval offers check your credit.

- You apply for a preapproval for a loan or mortgage. (not to be confused with a mortgage application, which is a hard pull)

Although soft inquiries don’t impact your credit score, they are listed on your credit report.

How do hard pulls affect your credit score?

A hard inquiry requests your full credit history and credit score from a credit bureau such as Experian, Equifax and TransUnion. The lender or creditor making the request has the option to choose the bureau and credit report style that best fit its needs.

Note that any type of hard credit inquiry will be reported on your credit report, causing a small credit score decrease. Usually between three and five points. These hard inquires remain on your credit score for two years. So, be aware of this when trying to sign up for new travel credit cards. If you have many hard inquiries in a short time period, you will see a more dramatic decrease in your credit score and be considered a higher risk to lenders. Chase is known for its 5/2 rule. This means they will automatically deny you if you have five inquires within two years.

Unlike hard inquiries, soft credit inquiries do not affect your credit score, because they don’t provide a creditor with your full credit report.

How many hard pulls are too many?

Keep your inquires and pulls to a minimum if possible, because if you have five or more on your account, you will be consider below average. Again, this aligns with the Chase rule of thumb

New inquiries are said to make up for 10% of your score. TransUnion lists credit behavior and new accounts as a “less influential” factor.

While you’ll want to avoid unnecessary inquiries on your account, don’t let the possibility of having another hard pull on your report stop you from applying for a new credit card if your score is otherwise healthy.

Conclusion

By now, you should know the difference between a hard pull and soft pull. A soft pull is not a big deal and will not hurt your score in the long run. A hard pull will take a small bite out of your score for two years or so. Its important to always be aware of your financial wellbeing, while making the best choices for your future.

When is the last time you had your credit report checked?

Previous Post

Previous Post Next Post

Next Post