Points & miles can add up fast before your next trip and you want to make sure to maximize your rewards!

I use a small army of major credit cards to book my flights, accommodations and rental cars. These cards below offer me the most value, but your situation may be different.

Updated: October 2023

So many cards, so little time

With so many choices out there, it can be difficult to choose the best travel credit card. There are literally hundreds upon hundreds options out there — and so many of them seem to be the same! How do you know which one is right for you? Or which one gives you the best rewards? Are the fees worth it? Which gives you the best perks?

For someone who isn’t deep into the credit card industry, it can be very confusing — and a bit nerve-wracking — to figure out which card to get.

But let me say this: there is no “best card.” The best travel credit card is the one that aligns with your travel goals.

Disclaimer: This post contains affiliate links. If you book or buy something through these links, I earn a small commission (at no extra cost to you! win-win).

How do you pick a travel rewards credit card?

First things first! Do not invest your time researching credit cards if you can’t pay your bill on a monthly basis. Also, this goes without saying but, you need to be able to pay your bill on time.

Otherwise, getting into the points game is not for you. You will quickly find yourself in debt and buried under high interest rates and all your hard work of earning points will go to waste.

Enough disclaimers, let’s move into the first step.

Get the card(s) that match your goal.

Obviously, the airline and hotel cards you’ll pick are going to be based on those you use a lot. For example, I have an American Airlines card because they have a huge hub in Chicago (ORD).

But, for those general points credit cards, some are way better than others. If you don’t have any specific goals in mind and are just looking for some you can use in your day-to-day life…

My Top Pick: Capital One Venture

I use my CapitalOne Venture card for everyday expenses to earn 2x the miles on anything (super rare in travel!) that I buy.

Since 2017, I’ve purchased countless trips and redeemed miles for destinations like Maui, Portugal, Thailand, Greece & Spain.

I absolutely think that with it;s current offer, this should be your first travel card.

Benefits:

- 75,000 bonus miles once you spend $4,000 within the first 3 months

- 2x miles on every dollar spent

- 5x miles on hotels and rental cars booked through Capital One Travel

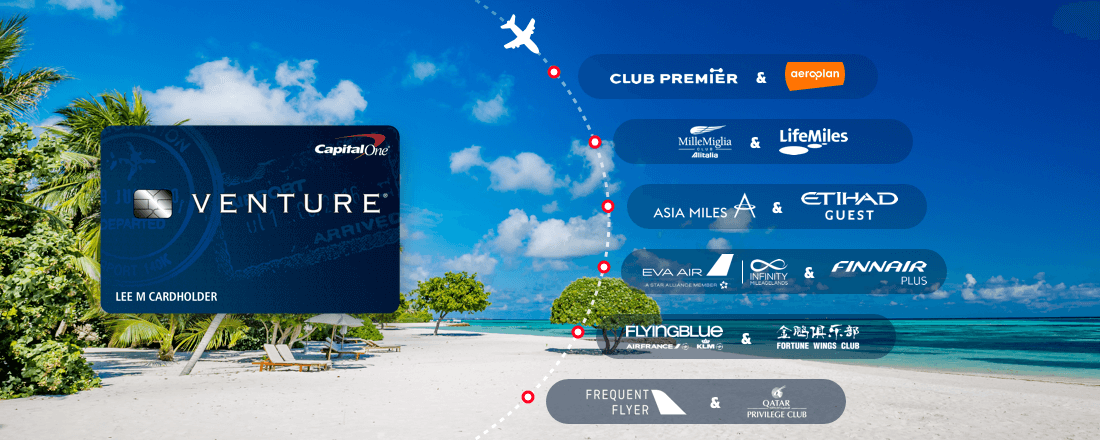

- Transfer miles to any of their 15+ travel partners

- Up to $100 credit for Global Entry or TSA PreCheck

- No foreign transaction fees

- 2 airport lounge visits per year

- $95 annual fee

There is no perfect card...

There is only the perfect card for YOU!

By first focusing on what you want, you can maximize your short-term goals and get the hang of travel hacking.

Do you want to fly for free? Stay for free?

Do you just want a card that won’t charge you a fee for using it abroad?

Is elite status important to you?

Do you want points you can use like cash for anything?

Are you interested in being loyal to a specific hotel chain?

There are a ton of credit card companies trying to grab your attention. Each of them offer different benefits, included rental car insurance, big bonus signups, rewards points and travel partners.

There are two cards that you should consider as your first travel rewards credit card

These cards are the Chase Sapphire Preferred and CapitalOne Venture.

Use the CapitalOne Venture card for everyday expenses like gas, the electric bill, Target, Walmart, Home Depot, etc.

Use the Chase Sapphire Preferred card for travel expenses, dining, online grocery and streaming services.

By using this method, you can eventually have both of these cards while maximizing the point system of each brand.

So how do you find the card that is right for you?

Well you can use my strategy, or find one that works better for you.

Do you live near an American Airlines hub? What about United or Delta? Do you love Marriott or Hilton Hotels?

By focusing on your travel goals, you can maximize rewards and points that work for you.

Figure out your travel goals and then find the cards that match your goals, as well as your spending habits.

My Travel Credit Card Recommendations

Capital One Venture

The “what’s in your wallet” card has been in my pocket for a long time now.

For all purchases with the Capital One Venture card, you are earning 2x the points for every dollar you spend.

The sign-up bonus on the Capital One Venture card is usually 50,000 points or greater, which is tremendous value. 50,000 points can take you a great distance and reward redemptions vary depending on location.

Highlights:

- 75,000 bonus miles once you spend $4,000 within the first 3 months

- 2x miles on every dollar spent

- 5x miles on hotels and rental cars booked through Capital One Travel

- Transfer miles to any of their 15+ travel partners

- Up to $100 credit for Global Entry or TSA PreCheck

- No foreign transaction fees

- 2 airport lounge visits per year

- $95 annual fee

CapitalOne Rewards Travel Portal

The main perk with the Capital One Venture card is earning unlimited 5 miles per dollar on hotels and rental cars booked through Capital One Travel.

With Capital One’s partnership with Hopper and their price prediction algorithm, tracking flights is super easy and you will know (roughly) the best time to purchase a fare

Is this the right card for you?

In addition to 2x the points on everyday purchases, your also covered for Auto Rental Collision Damage Waiver and Extended Warranty Protection. For those who travel internationally, Capital One offers a $100 credit on Global Entry and TSA Pre-check.

If you can’t find a good use for your Capital One miles, feel free to transfer them to 15+ travel partners in the Capital One network. Talk about perks!

Overall, the Capital One Venture card is one of the easiest to use in the travel rewards space. It’s super easy to earn and redeem.

The Chase Sapphire Preferred card is great for beginners and travel-hacking seasoned veterans.

If you apply for the card at the right time, you can earn big bonuses.

However, you need to spend $4,000 in the first three months to be eligible. Chase requires a $95 per year fee to hold the power of the Sapphire Preferred card and its benefits. If $4,000 seems like too much, how about using the card to pay for utility or recurring monthly bills?

Use the CSP for online groceries, dining, and steaming services. Each category earns 3x rewards.

Highlights:

- Earn 60,000 bonus points after you spend $4,000 in the first 3 months

- 2x points on travel purchases

- 3x points on restaurants, online grocery purchases, and select streaming services

- 5x points on travel purchased through the Chase travel portal

- 5x points on Lyft

- 10% anniversary points boost (earn bonus points equal to 10% of your total purchases made the previous year)

- Free DoorDash DashPass subscription

- $50 Annual Ultimate Rewards Hotel Credit

- No foreign transaction fees

Chase Ultimate Rewards Travel Portal

Chase rewards are great because they are incredibly flexible for award travel. You can transfer Chase point to 13 different airline and hotel travel partners. Those options make it easy to book everything from beach-side resorts to lie-flat business-class seats. But did you know you can use your Chase Ultimate Rewards points for more than just fancy hotels and expensive flights with travel partners?

The Chase travel portal is a powerful tool you can use to book rental cars, tours, event tickets, and more with Chase Ultimate Rewards points. It’s super easy to book travel on the Chase Ultimate Rewards site and in many cases it can cost fewer points to book through the travel portal instead of transferring your Chase points to travel partners.

Want insurance covered on your rental car? Chase has your back.

Chase Ultimate Rewards points are my favorite transferable points for a lot of reasons. They transfer to a lot of great travel partners and they’re easy to earn

Is this the right card for you?

The bottom line is that Chase Reward points are useful for more than just airfare and hotels.

You can use the Chase travel portal to book everything from rental cars to boat tours to vacation rentals. This makes it easy to use your Chase Ultimate Rewards points to save on the other travel expenses.

In addition to 1x the points on everyday purchases, your also covered for primary car rental insurance and trip cancelation and interruption protection.

American Express® Gold

This card is a great choice for travelers who enjoy dining out, as it offers 4x points on restaurants and groceries, 3x points on flights, and $120 Uber Cash (which you can use on rides or UberEats).

You’ll earn Membership Rewards® points, which you can transfer to any of their 16 travel partners, some of which overlap with Chase’s transfer partners and some which Chase does not have (like Delta). When you sign up for this card, you get:

Highlights:

- Earn 60,000 points (after spending $6,000 in eligible purchases in the first 6 months)

- 4x points on restaurants worldwide (plus takeout/delivery in the US)

- 4x points on US supermarkets (on up to $25,000 per calendar year in purchases, then 1x)

- 3x points on flights (when booked directly or on amextravel.com)

- $120 in Uber credit (distributed as $10 in Uber Cash each month when you add your Gold Card to the Uber app)

- $120 in dining credit (at select companies/restaurants, enrollment required)

- No foreign transaction fees

American Express Membership Portal

The American Express Membership Rewards program gives Card Members flexible ways to earn points on eligible purchases, plus a variety of redemption options.

There are seven main ways Card Members can redeem points, depending on their particular Card and other factors:

- Pay with points at checkout

- Redeem for gift cards

- Cover your Card charges

- Book or upgrade travel

- Transfer points to travel partners

- Go shopping online

- Give back

No matter how you choose to redeem Membership Rewards points, note that Card Members are responsible for paying any federal, state, or local taxes that might apply.

Is this the right card for you?

If you are a foodie and/or near a Delta hub, this is a great card to have in your wallet. The $250 yearly fee is steep, but if you make use of your rewards and other perks, it can be worth it.

Capital One Venture X - Premium Travel Rewards Credit Card

This card got an overhaul a few years ago. It has all the perks you’d expect of a top-notch credit card, including a generous welcome bonus, lounge access, travel credits, and a solid points-earning structure. At $395, it’s the cheapest premium travel credit card out there, and the 2x points you can earn on every purchase as well as no fee for up to four authorized users are both unique in this class of card.

When you sign up for this card, you get:

Highlights:

- 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months

- 10x miles on hotels and rental cars booked through Capital One Travel

- 5x miles on flights booked through Capital One Travel

- 2x miles on all other purchases

- $300 travel credit when booking through the Capital One portal

- $100 credit for Global Entry or TSA PreCheck®

- Unlimited complimentary access to Capital One, Priority Pass, and Plaza Premium lounges

- 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Travel insurance coverage including primary car rental insurance, trip interruption and cancellation, luggage reimbursement

Capital One Travel Rewards Portal

A big perk with the Capital One Venture X card is earning unlimited 10 miles per dollar on hotels and rental cars and 5x the miles on flights booked through Capital One Travel.

With Capital One’s partnership with Hopper and their price prediction algorithm, tracking flights is super easy and you will know (roughly) the best time to purchase a fare

Read More: Maximizing Your Rewards with Capital One

Is this the right card for you?

The Venture X is best for people that want a straight-forward card with a higher-than-normal earning rate on all purchases and that are happy to book through the Capital One travel portal in order to receive the bonus spend rates.

Once you know what card is best for you, hit “Apply now”.

The credit card company will ask for your legal name, birthday, social security number and a few other things to get started.

Capital One Venture

- 75,000 bonus miles once you spend $4,000 within the first 3 months

- 2x miles on every dollar spent

- 5x miles on hotels and rental cars booked through Capital One Travel

- Transfer miles to any of their 15+ travel partners

- Up to $100 credit for Global Entry or TSA PreCheck

- No foreign transaction fees

- 2 airport lounge visits per year

- $95 annual fee

Chase Sapphire Preferred

- Earn 60,000 bonus points after you spend $4,000 in the first 3 months

- 2x points on travel purchases

- 3x points on restaurants, online grocery purchases, and select streaming services

- 5x points on travel purchased through the Chase travel portal

- 5x points on Lyft

- 10% anniversary points boost (earn bonus points equal to 10% of your total purchases made the previous year)

- Free DoorDash DashPass subscription

- $50 Annual Ultimate Rewards Hotel Credit

- No foreign transaction fees

- $95 annual fee

Capital One Venture X

- 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months

- 10x miles on hotels and rental cars

- 5x miles on flights

- 2x miles on all other purchases

- $300 travel credit when booking through the Capital One portal

- $100 credit for Global Entry or TSA PreCheck®

- Unlimited complimentary access to Capital One, Priority Pass, and Plaza Premium lounges

- 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Travel insurance coverage

- $95 annual fee ($300 travel credit)

Once you’re approved and get confirmation from the credit card company via email or snail mail, start thinking about meeting the spending requirement before you receive your physical card in the mail.

Usually any given card will take 5-7 business days to get to your mailbox.

Remember, most of the time you only have three months to meet the requirement, so activate the card and start spending immediately. Think about your spending and habits; groceries, gas, coffee, dinner, utilities, etc.

The faster you meet the spending requirement, the quicker you will receive your bonus miles and then you can book your next trip!

What other questions do you have about travel credit cards or travel rewards in general?

Book Your Trip Now!

Below are my favorite companies I use time and time again when I book my travel.

- Travel Coupons & Discounts – Get Cash Back at places like Hotels.com, Expedia, Travelocity, Priceline and many more with Rakuten. Sign up today & get $30!

- My Favorite Travel Credit Card – Chase Sapphire Prefered. This is by far the best way to book travel and earn miles/points while doing so. Use the Chase Sapphire Prefered for booking 3x travel, 3x dining and 3x on streaming services.

- My Second Favorite Travel Credit Card – In my opinion, the second best travel rewards credit card, the Capital One Venture. Use the Capital One Venture card for 2x the rewards on everyday purchases.

- Rental Cars – Search, compare and save on the best rental car company brands all in one place using DiscoverCars.

- Booking.com – Booking has the widest selection of budget accommodation in the world. In our studies, they constantly found the cheapest rooms. I also like their easy-to-use interface and no-money-down policy.

- Hotels.com – Hotels.com is my second choice for finding hotels. I love their selection and easy to navigate website. Use it often for free hotel stays with OneKeyCash.

- VRBO – The most popular vacation rental site in the US. ✓+2 million rentals worldwide ✓19+ million reviews ✓Secure online payment

- Selina Hostel – This is the best hostel accommodation in the world. Their unique CoLive stays, artwork and location are the best. Not to mention, they are a great value travel brand!

For companies, check out my favorite travel companies section that includes even more of my favorite travel companies that will help you value travel!