Disclaimer: This post contains affiliate links. If you book or buy something through these links, I earn a small commission to keep this website going (at no extra cost to you) so its a win-win!

When it comes to travel credit cards, choosing the right one can feel overwhelming. With enticing offers, flashy perks, and endless possibilities, how do you determine which card delivers the most bang for your buck?

If you’re a savvy traveler looking to maximize rewards, minimize hassle, and elevate your adventures, the Capital One Venture X Rewards Credit Card is the standout winner.

Let’s dive into why this card rises above the rest and how it can transform your travel experiences.

First Impressions: The Welcome Bonus

A compelling feature of any travel credit card is its welcome bonus, and the Venture X doesn’t disappoint. New cardholders can earn a hefty 75,000 bonus miles after spending $4,000 within the first three months. That’s equivalent to $750 toward travel when redeemed through the Capital One Travel portal or even more value when transferred to one of Capital One’s travel partners. Whether you’re planning a European getaway or a domestic adventure, this bonus is a solid head start on your next trip.

Earning Miles: Everyday Spending Made Rewarding

The Venture X card simplifies earning miles without compromising value. You’ll enjoy 2X miles on all purchases, so whether you’re buying groceries, paying for gas, or splurging on a new travel backpack, every dollar spent works toward your next trip. But the real magic happens when you book through the Capital One Travel portal. Here, you’ll earn 10X miles on hotels and rental cars and 5X miles on flights. These accelerated earning rates can supercharge your rewards balance, especially for frequent travelers who book regularly through Capital One’s intuitive platform.

Travel Perks That Go the Extra Mile

One of the most impressive features of the Venture X is its premium travel benefits, which are designed to enhance every aspect of your journey. For starters, the card offers an annual $300 travel credit for bookings made through the Capital One Travel portal. This credit alone offsets a significant portion of the card’s $395 annual fee. Add to that the 10,000 bonus miles you receive each year on your account anniversary, worth $100 toward travel, and you’ve essentially negated the cost of owning the card.

Frequent flyers will also appreciate the complimentary Priority Pass membership, granting access to over 1,300 airport lounges worldwide. Capital One’s own airport lounges, like the flagship location in Dallas-Fort Worth (DFW), are also included, offering modern amenities, gourmet snacks, and relaxation spaces to elevate your layover experience.

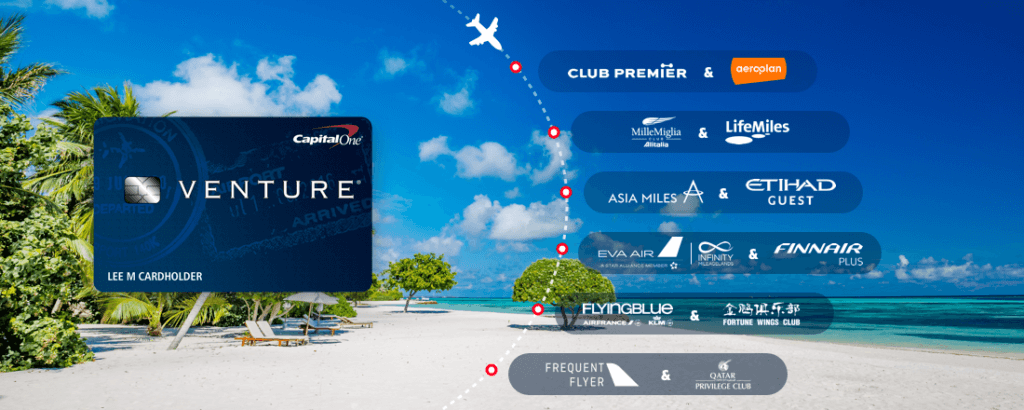

Flexibility with Transfer Partners

Capital One’s transfer partner program is where the Venture X card truly shines for the seasoned traveler. The card allows you to transfer miles to over 15 airline and hotel partners, often at a 1:1 ratio.

Partners include popular programs like Air Canada Aeroplan, Turkish Airlines Miles&Smiles, and Wyndham Rewards. This flexibility means you can unlock incredible redemption opportunities, such as flying business class to Europe for a fraction of the cost in miles or booking a luxurious hotel stay. For those willing to strategize, the value of these transfers can far exceed the 1 cent per mile offered through the travel portal.

Personally, I’ve used my Capital One travel miles on numerous round trip flights (Europe, Asia, South America) since I opened the card. With my travel style, I believe that flights are the most bang for my travel miles over luxurious hotels, as I rarely stay in them.

Travel Protections and Peace of Mind

Travel isn’t always smooth, but the Venture X card ensures you’re protected from unexpected hiccups. Cardholders benefit from travel insurance perks, including trip cancellation/interruption coverage, lost luggage reimbursement, and primary rental car insurance. These protections can save you hundreds of dollars and countless headaches if plans go awry. Additionally, the card has no foreign transaction fees, making it an ideal companion for international travel.

Comparing the Competition

When pitted against other premium travel cards, the Venture X holds its ground—and then some. Compared to the Chase Sapphire Reserve, which also offers robust travel perks but carries a higher $550 annual fee, the Venture X delivers comparable value at a more accessible price point.

While the Platinum Card® from American Express boasts extensive lounge access and luxury benefits, its $695 annual fee and higher spending requirements for earning rewards make it less appealing to travelers seeking a balance between cost and perks.

The Venture X bridges this gap beautifully, offering premium benefits at a price that’s easier to justify.

Who Should Get the Venture X?

The Venture X card is perfect for travelers who want to get the most bang for their travel buck while making redemptions super easy:

-

- Book travel frequently: The earning rates for bookings made through the Capital One Travel portal are hard to beat.

-

- Value premium perks: From lounge access to annual credits, the card’s benefits enhance both the journey and the destination.

-

- Want flexibility: The ability to transfer miles to airline and hotel partners or redeem them directly for travel makes this card a versatile choice.

-

- Travel internationally: With no foreign transaction fees and global lounge access, it’s a solid companion for trips abroad.

Final Thoughts: Why the Venture X Delivers the Most Value

The Capital One Venture X Rewards Credit Card isn’t just a credit card; it’s a travel companion that pays dividends with every swipe. Its powerful combination of earning potential, premium perks, and flexibility makes it a top contender in the travel credit card space. Whether you’re jetting off to a distant shore or exploring your local wonders, the Venture X ensures you’re always earning, always protected, and always elevating your experience. For travelers who want maximum value without excessive costs, this card is the ultimate ticket to rewarding adventures.

Book Your Trip Now!

Below are my favorite companies I use time and time again when I book my travel.

- Travel Coupons & Discounts – Get Cash Back at places like Hotels.com, Expedia, Travelocity, Priceline and many more with Rakuten. Sign up today & get $30!

- My Favorite Travel Credit Card – The Capital One Venture X is by far the best way to earn & book travel with easy redemption possibilities.

- Second Favorite Travel Credit Card – The Chase Sapphire Prefered. Use the Chase Sapphire Prefered for booking 3x travel, 3x dining and 3x on streaming services.

- Rental Cars – Search, compare and save on the best rental car company brands all in one place using DiscoverCars.

- Booking.com – Booking has the widest selection of budget accommodation in the world. In our studies, they constantly found the cheapest rooms. I also like their easy-to-use interface and no-money-down policy.

- Hotels.com – Hotels.com is my second choice for finding hotels. I love their selection and easy to navigate website. Use it often for free hotel stays with OneKeyCash.

- VRBO – The most popular vacation rental site in the US. ✓+2 million rentals worldwide ✓19+ million reviews ✓Secure online payment

- Selina Hostel – This is the best hostel accommodation in the world. Their unique CoLive stays, artwork and location are the best. Not to mention, they are a great value travel brand!

For companies, check out my favorite travel companies section that includes even more of my favorite travel companies that will help you value travel!

Previous Post

Previous Post